What is TouristPay

TouristPay is a government-aligned regulatory technology program designed to help banks, central banks, regulators, and governments manage and distribute Digital Local Currency (DLC) at scale.

As a Business-to-Government (B2G) solution, TouristPay does not serve individual users directly. Instead, we empower regulated institutions in the origin country to offer their users access to destination countries’ local currencies—digitally, compliantly, and without the need for a physical or licensed presence abroad.

TouristPay facilitates everything from bulk DLC allocation to cross-border banking integration, enabling secure, transparent, and cashless economic participation for inbound individuals—tourists, students, and diaspora—while supporting national policy objectives in financial inclusion and monetary stability.

Our Mission

In today’s fast-paced digital age, innovative and smart payment solutions are critical to meeting the evolving needs of businesses and customers alike. The traditional payment infrastructure is no longer sufficient to keep up with the demands of modern-day transactions, which require faster and more efficient payment processing. Innovative payment solutions can help businesses streamline payment processes, reduce transaction times, and improve customer experiences. Additionally, with the growing prevalence of digital transactions and online commerce, the need for secure payment solutions that protect customer data and prevent fraud is more pressing than ever. By adopting innovative and smart payment solutions, businesses can stay ahead of the curve and provide their customers with a seamless and secure payment experience.

Our Mission

In today’s fast-paced digital age, the tourism experience needs an update. The traditional payment infrastructure/regulations are no longer sufficient to keep up with the demands of modern-day transactions, which require faster and more efficient methods. Our solutions can help businesses and governments streamline payment processes, reduce transaction times, and improve tourist/customer experiences. Additionally, with the growing prevalence of digital transactions and online commerce, the need for secure payment solutions that protect customer data and prevent fraud is more pressing than ever. By adopting innovative and smart payment solutions and policies, businesses/regulatory bodies can stay ahead of the curve and provide their customers with a seamless and secure payment experience.

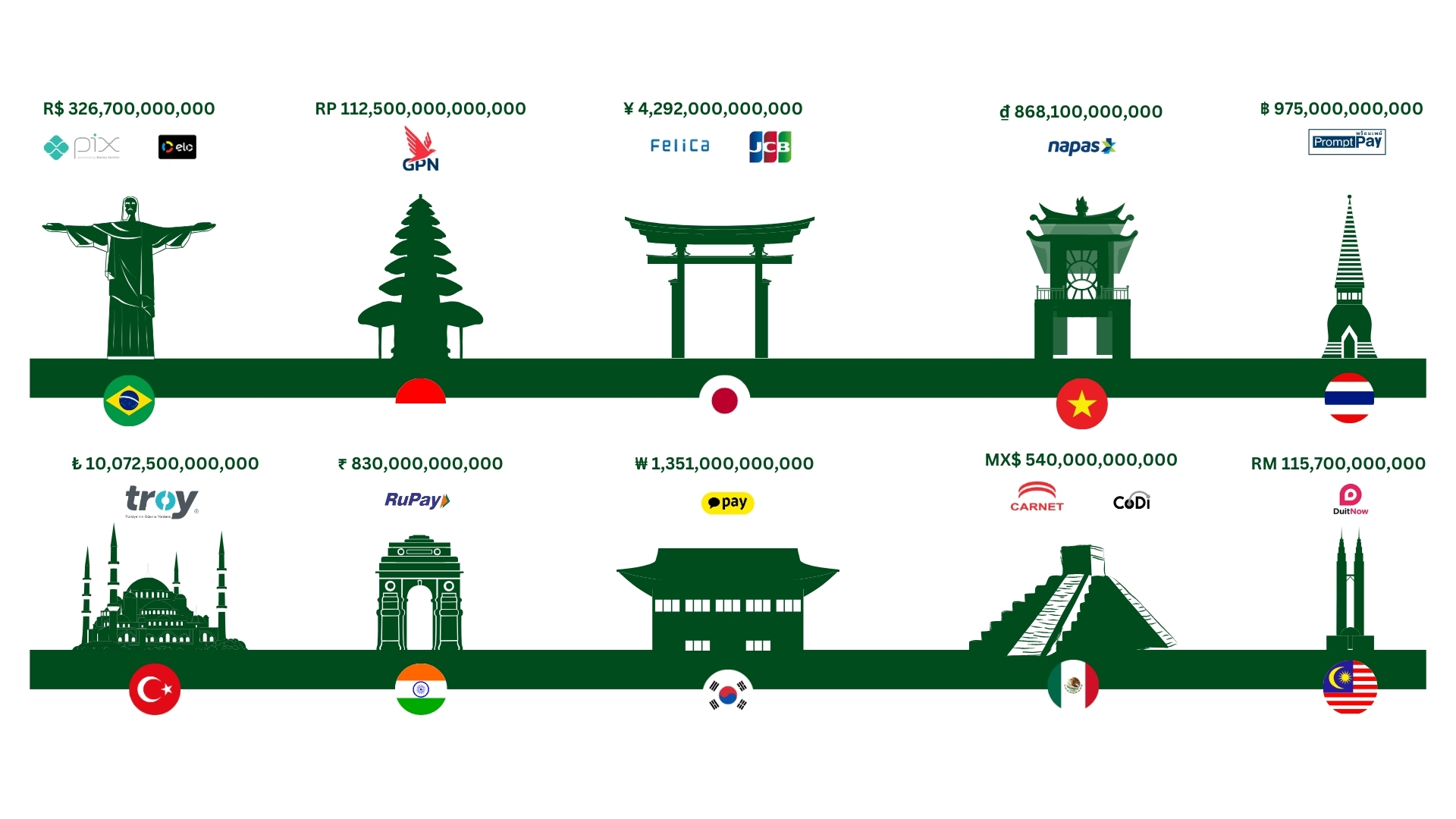

Top 10 tourist destination with revenue in Local Currency and the country’s local payment schemes